Unified monthly reporting by employers, or a revolution in digitalisation

The new Unified Monthly Reporting Act (JMHZ) is expected to simplify administration for employers from 2026. The existing up to 25 different reports will be replaced by one summary, which will be submitted to only one authority. At the same time, however, we must prepare for the fact that the reporting will contain detailed information on employees that has not been reported so far.

The JMHZ principle

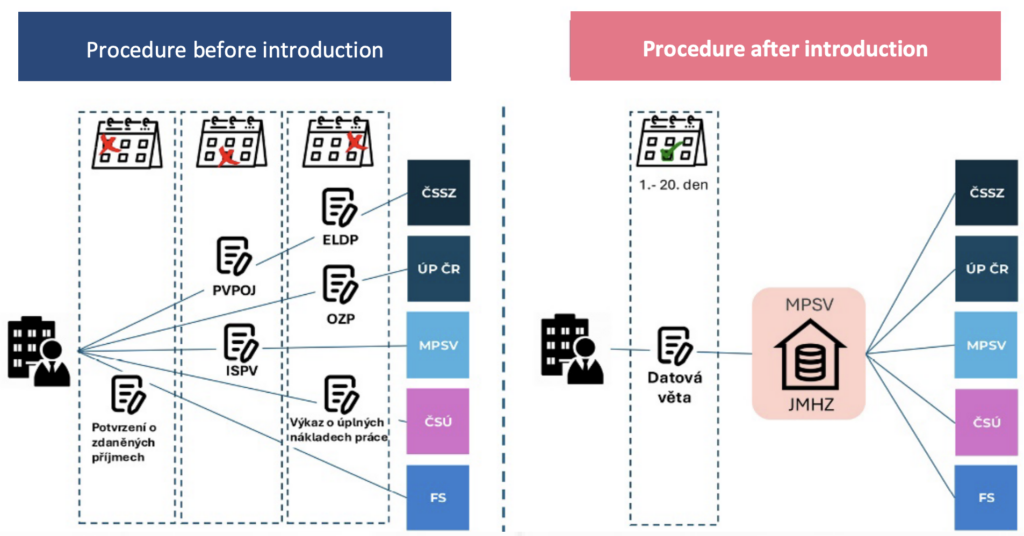

This project is intended to simplify administration and improve the efficiency of public administration by centralising and exchanging data between institutions.

Currently, employers send various reports at different dates to countless authorities. These include the tax administration, social security administrations, labour offices, the Czech Statistical Office and the Ministry of Labour and Social Affairs.

The current practice will be replaced with a single report sent to the Czech Social Security Administration. The superior Ministry of Labour and Social Affairs will be responsible for transferring data to other authorities. The procedure is clearly summarised in the following diagram.

Source: Ministry of Labour and Social Affairs, adapted

Health insurance companies will be added in the next phase.

Employers will submit their unified monthly reporting electronically in XML format by the 20th day of the following month.

Benefits for employees from the JMHZ project should include simplification of the process for applying for state social support benefits and unemployment benefits, as the authorities will already have the necessary data available thanks to the JMHZ, while the preparation of tax returns should also be simplified. As well as the authorities, it will also be possible to grant limited consent to, for example, a bank, which will thus obtain data on the income of an employee applying for a loan or mortgage.

Effect of the JMHZ

The law is set to come into effect on 1 January 2026, with some employer recording obligations and the obligation to submit monthly reporting being postponed to 1 April 2026 as part of the amendments procedure.

However, employers will have until June 2026 to submit the missing data for the first three months of 2026.

The pilot operation of the JMHZ, involving selected employers, payroll system operators and public authorities, already started on 1 July 2025.

Content of the reporting

The exact content of the monthly reporting is not yet known, but it is clear that the reporting should contain in particular the following information:

- reporting on individual employees and jobs

- details of monthly income paid to employees – including income that is not taxable (e.g. tax-exempt income)

- detailed information on all employee benefits

- information on the tax base, assessment base, and individual contributions for income tax from dependent activities, health insurance and social insurance

The state administration will thus receive data about employees and their income from dependent activities every month, including detailed information about individual benefits. Under the JMHZ, a large quantity of data that employers are now required to keep internally will be provided directly to the relevant authorities, which previously only received such data upon request during inspection activities. The state administration will thus have a structured and individualised overview of income from dependent activities almost in real time.

We must not forget that these data are not only used by the tax administration when assessing income from dependent activities, but also when assessing tax deductibility for corporate income tax.

Other expected developments

We expect further progress on this topic in October 2025, when the structure and content of the form should be published.

In the second phase of the JMHZ project, it is planned to introduce a new service for pre-filling tax returns based on information obtained from employers through the JMHZ.

In the future, the unified employer reporting should also be followed by the simplification of state contribution payments. The goal is for the total amount of all contributions to be sent in one payment to a single collection point (JIM), from which payments will then be distributed among the individual institutions without the employer’s involvement. However, the earliest the single collection point will be launched is 2027.

We will be following the JMHZ topic closely and will certainly return to it in future issues of News.

In case of specific questions, please do not hesitate to contact us, we are always at your disposal.

Team WTS Alfery

The JMHZ principle

| Procedure before introduction | Procedure after introduction | |||||

|---|---|---|---|---|---|---|

| CSSA | CSSA | |||||

| PVPOJ (Insurance premium overview) | ELDP (Pension insurance record sheet) |

LO CR |

1st to 20th day |

LO CR |

||

| Confirmation of taxed income |

ISPV (Information and statistics on average earnings) |

OZP (Sector health insurance company) | MLSA | MLSV JMHZ |

MLSA | |

| Report on total labour costs | CSO | Data rec- ord |

CSO | |||

| FA | FA | |||||